texas estate tax limits

Texas law establishes the process followed by local officials in determining the value for property ensuring that values are equal and. However any taxable estate value over 12 million will be taxed at the rate of 40.

What Is The Probate Process In Texas A Step By Step Guide

Ad Estate Planning Law Firms - Lawyer - Attorney Directory - Wills Trusts Tax Law.

. Under current federal tax law estates with a value of less than 54. There is a 40 percent federal tax however on estates over 534 million in value. So inheritors should not expect to pay any property tax on real estate acquired from a deceased parent as it is real property.

Of all the states Connecticut has the highest exemption amount of 91 million. The current exemption doubled under the Tax Cuts. The size of the estate tax exemption meant that a mere 01 of estates filed an estate tax return in 2020 with only about 004 paying any tax.

The tax rate ranges from 116 to 12 for 2022. The estate tax rate is based on the value of the decedents entire taxable estate. You must have filed for the homestead exemption.

Texas legislators have tried numerous ways to limit property tax growth. Its inheritance tax was repealed in 2015. Because both tax rates and property values fluctuate year to year property tax bills can be a scary unknown.

Theres more good news. If a taxing unit raises more than 8 of the property tax revenue of the previous year voters can file a petition. The current amount is 1206 million.

The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. It is offered for sale in the open market with a reasonable time for the seller to.

Texas has no income tax and it doesnt tax estates either. The current cap for the annual increase is 8. That 10 percent cap is why our net appraised value for 2022 is preliminarily pegged at.

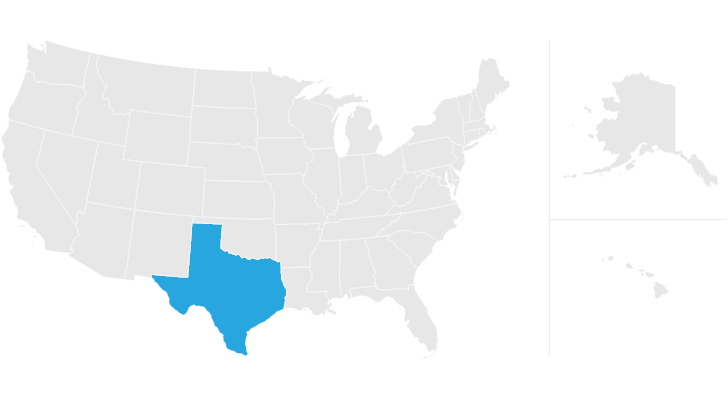

In Texas the federal estate tax limits apply. Texas also imposes a cigarette tax a gas tax and a hotel tax. In 2018 the thresholds for a single persons Texas estate tax were estimated to be 58 million and 112 million for a married couple.

Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and many other services. Get Matched With A Qualified Estate Planning Lawyer For Free. Fortunately in Texas if you have a homestead exemption in place your property tax appraisal increase limit is capped at 10 year over year which helps to protect you from large annual increases in property tax.

Starting in 2023 it will be a 12 fixed rate. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. This means that the Texas Constitution also limits the Texas Legislature from imposing an inheritance or estate tax on real and personal property.

If that reappraisal occurred two years ago your new assessed value can exceed last years by 20. Once again Texas has no inheritance tax. The 10 increase is cumulative.

The limitation applies only to a residential homestead. Texass median income is. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold.

Theres no personal property tax except on property used for business purposes. If the amount were lowered this significantly in the upcoming year many individuals who currently will not have to pay an estate tax will be forced to. The 10 limitation is an annual limit to the assessed or taxable value and it dates from the latest reappraisal.

Although some states have state estate inheritance or death taxes at a lower threshold Texas follows the federal estate tax limits the amount you can leave to your heirs without estate tax which is estimated based on inflation numbers to be 56 million for a single person. Any estate that exceeds these thresholds is subject to the federal estate-tax of 40. Technically a Texas homesteads assessed value is limited to the lesser of either its market value or the sum of the market value of any new improvements and 110 of the appraised value of the preceding year.

According to state law the taxable value for a homestead cannot increase more than 10 percent a year. The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. 2018 ESTATE TAX EXEMPTION TO BE 56 MILLION PER PERSON EVEN WITHOUT TAX REFORM.

The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. Currently California only allows up to a 2 increase based on the value of the property.

Most Americans will never have to pay a dime in estate tax because the federal government exempts all estates worth less than roughly 12 million from its estate tax. The Estate Tax is a tax on your right to transfer property at your death. Also good news over 90 percent of all Texas estates are exempt from federal estate taxes.

However this past year there were proposals seeking to reduce the amount to 35 million per individual. Lawmakers have raised the states homestead exemption the portion of a homeowners home value exempt from taxation. Property Tax System Basics.

With few exceptions Tax Code Section 2301 requires taxable property to be appraised at market value as of Jan. Meanwhile in Texas property appraisals have reached 10. The homeowners property tax is based on the county appraisal districts appraised value of the home.

If an estate is worth 15 million 36 million is taxed at 40 percent. An advantage of the exemption is that value for taxation can be controlled by a limit each year up to a specified level. There will be a 248996 assessment in 2021.

Take a look at the table below. Individuals whose primary residence is exempt from Texas Property Tax Code taxation are able to claim such an exemption. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF.

Market value is the price at which a property would transfer for cash or its equivalent under prevailing market conditions if. The sales tax is 625 at the state level and local taxes can be added on.

Sales And Use Tax Rates Houston Org

Texas Inheritance And Estate Taxes Ibekwe Law

Texas And Tx State Individual Income Tax Return Information

Texas Estate Tax Everything You Need To Know Smartasset

Texans Stunned By Property Tax Hikes

Texas Estate Tax Everything You Need To Know Smartasset

You Might Not Like A Particular Parent For Some Behavior He Or She Pursues The Same Might Be Your Concern With Respect To A Visitation Rights Tug Of War Tug

Texas Estate Tax Everything You Need To Know Smartasset

Don T Die In Nebraska How The County Inheritance Tax Works

How Long Does A Speeding Ticket Stay On Your Record D Turner Legal Llc Speeding Tickets Records Ticket

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Money In Investor Pockets Leads To Net Lease Rising Interest Rates Are Putting Pressure On Pricing But The Fundamentals Of Net Le Investors Lease House Styles

The Long Long History Of The Texas Property Tax

What Is A Homestead Exemption And How Does It Work Lendingtree

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Over 65 Property Tax Exemption In Texas

Texas Estate Planning Statutes With Commentary 2019 2021 Edition Paperback Walmart Com Estate Planning Estate Administration How To Plan

State Corporate Income Tax Rates And Brackets Tax Foundation